11 Set Trade Graph Habits Cheating Layer Review

The newest reverse are confirmed if rates holes on the opposite direction, making the newest isolated price action trailing. Speed ActionThe Rising Triangle pattern means that customers are receiving increasingly competitive, pushing the cost large with every pullback, if you are vendors safeguard the fresh resistance height. The fresh https://srishtisoft.com/best-self-help-guide-to-algorithmic-exchange-tips/ narrowing rates step between the up-sloping trendline and the resistance line indicators one a good breakout is impending. As the rates vacations above the opposition range, it confirms you to buyers have chosen to take handle, and also the uptrend can keep. The newest graph designs you see to your charts of various economic segments are built by the step away from investors and you may investors since the he is buying and selling their ranking in different timeframes.

Reverse and Continuation Designs

Similarly, the newest bearish harami begins with an effective bullish candle followed by an enthusiastic indecisive candle in variety. Both models highly recommend solid to purchase/promoting pressure and you will a continuation of your latest pattern. Buyers often utilize this trend in order to take advantage of the new impetus away from a trend, and it is a lot more reputable inside high-volume locations.

Chart Patterns Cheating Layer Faqs

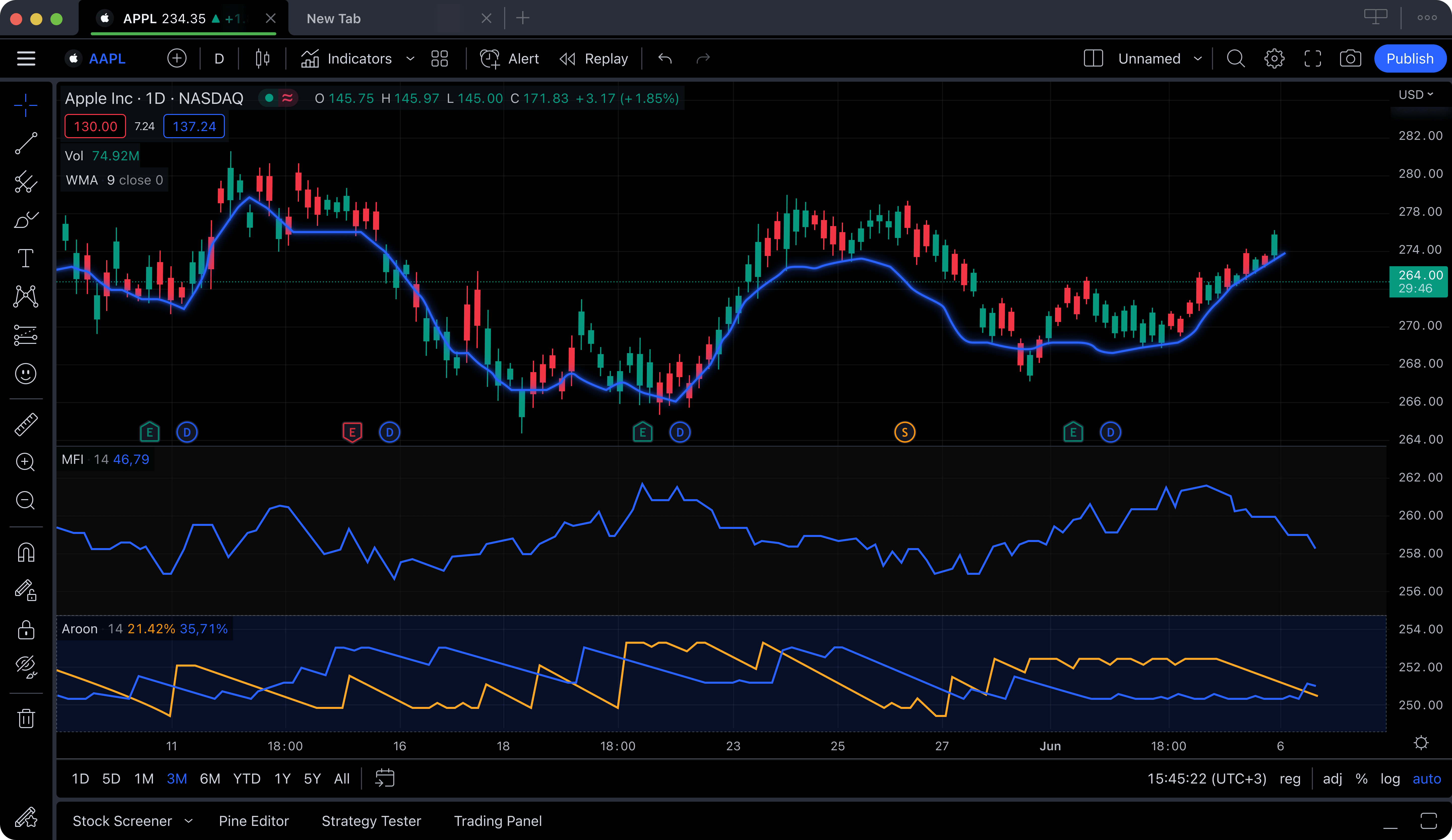

The image demonstrates how to utilize chart habits, specifically a parallel route, to create productive prevent loss. Right here, a simultaneous station formed by the hooking up rate ups and downs. Since the pattern are confirmed, people often use the directory of the new neckline in order to venture a good target speed on the down move. The new straight range between the tops plus the neckline can help imagine what lengths the price might slide. In the end, immediately after cracking underneath the neckline, you will find have a tendency to a great retest for the top.

Successive victories never imply you have “determined” industry, and consecutive loss usually do not suggest your technique is defective. Thanks to comprehensive research, Nison translated and you can subtle Japanese candlestick procedure, partnering him or her to your progressive technical study. His 1991 guide, Japanese Candlestick Charting Processes, became a seminal functions, extensively thought to be the new decisive publication about them. Now, on the higher-stakes realm of cryptocurrency trade, in which regulators principles can also be move the market at once, information these designs you will imply the essential difference between profit and loss.

That it island reverse trend is far more popular on the stock market maps and other areas in which indeed there isn’t plenty of exchangeability. Something to note because you you will need to exchange the fresh (inverse) glass and you will manage trend would be the fact it’s best at the end of a life threatening development. Within this bit, we’ll find 17 day exchange patterns and how to make use of them on your exchange. HowToTrade.com requires zero duty to possess losses sustained since the a results of the message provided in our Trade Academy. By enrolling as a associate you accept that people commonly bringing monetary advice and that you make the fresh choice to the the new deals you devote inside the fresh places. We haven’t any experience in the degree of money you are trading that have or the degree of exposure you take with each trading.

Ideas on how to Comprehend Chart Habits

It consists of a long bearish candle, a tiny indecision candle (often a good doji), and you may an extended bullish candle. It will be ideal for buyers to know that no graph development is most beneficial, which acquired’t constantly give them away having primary results. One of many things that may interrupt graph patterns is not true breakouts.

However, right status measurements and you will voice risk administration are very important. Upside objectives are sometimes achieved from the future days in case your uptrend continues on. Rates acts when it comes to waves, and also the surf give rise to inner surf which guide the brand new guidance of one’s price conclusion. A long entry are made in this analogy according to elliot revolution priniciple.

Double Best & Double Bottom

The newest abuse to do something punctually on your own edge is specially challenging just after experiencing losses. Internalize one even a good 75% win-rate approach often sense occasional losing lines, but hesitating for the legitimate configurations simply minimises your much time-term expectancy. A precise edge now offers goal conditions to own exchange options, removing personal emotions in the choice process.

If there’s a good breakout, this may code a potential reversal to your upside. Having a two fold base, the purchase price target is even usually the exact same distance since the point amongst the pattern’s assistance and resistance account. Which have a double-best development, the price address may be the same distance while the distance between your service and you may opposition levels of the fresh trend. When the marketplace is in the an excellent downtrend, a similar development can seem, referred to as ugly direct and you may shoulders, in which the neckline is actually a reluctance level instead of a help.

Investors would be to be the cause of complete business belief, reports occurrences, and economic indicators to help you confirm their development investigation. Always check high timeframes so that the development is situated in a correct perspective. For much more aggressive buyers, another option is always to place the prevent-losses just over the neckline (or less than on the inverse pattern). Yet not, this process is actually riskier and much more at the mercy of prevent runs and you may abrupt volatility spikes, that will too soon lead to the new stop-loss. Mode a stop-losses order is essential to have energetic exposure government.

Double best and twice base designs are reverse models one signal prospective pattern changes. A double best variations when rates has reached a top section twice, undertaking two distinctive line of peaks. A double bottom, as well, variations whenever price reaches a decreased part twice, performing a few distinct troughs.

The newest falling wedge development is actually an optimistic graph development noted by straight down highs minimizing lows converging to your just one point. The new dropping wedge seems to your graph while the converging pattern traces – a great descending top trendline connecting at least a couple of lower highs, and an ascending all the way down trendline connecting no less than two highest downs. That it versions a great wedge shape you to definitely narrows because the pattern contours flow nearer with her. The top of and lower trendlines gather during the an about equivalent direction, proving the fresh balanced force away from consumers and you may sellers. The brand new development is finished when the rate vacations away above the top trendline resistance otherwise beneath the down trendline help. The fresh advice of your resulting disperse hinges on the fresh direction out of the newest before development.

Sorry, the comment form is closed at this time.